Selling Your Business | 7 Strategies for Minimizing Taxes

Without careful planning, estate taxes can significantly diminish the value of a business owner's legacy and might even necessitate the sale of a family-owned business or property. While every business owner's circumstances are unique, there are several common estate planning strategies that can reduce the tax implications of asset transfers, potentially saving millions of dollars. These plans can be put in motion years or even decades before a significant financial event.

1. Giving Away Your Business

A straightforward strategy to pass part of the business value to your heirs is to give them an interest in the company during your lifetime, either directly or by funding a trust for their benefit. There are substantial tax benefits to transferring non-controlling interests in privately held companies. These shares can generally be valued at a discount to the public market price of your business due to two factors: lack of marketability and influence.

Consider that an interest in a private business is illiquid — meaning it is generally more difficult to buy or sell than comparable public market securities — reducing the market value of your gifts to your children since they cannot easily sell their interest for the total value. In addition, many business owners give their children non-voting shares or limit their ownership to a minority share in the company. As a result, they have little or no influence over the company’s operations. This lack of control makes their shares inherently less valuable than a controlling stake.

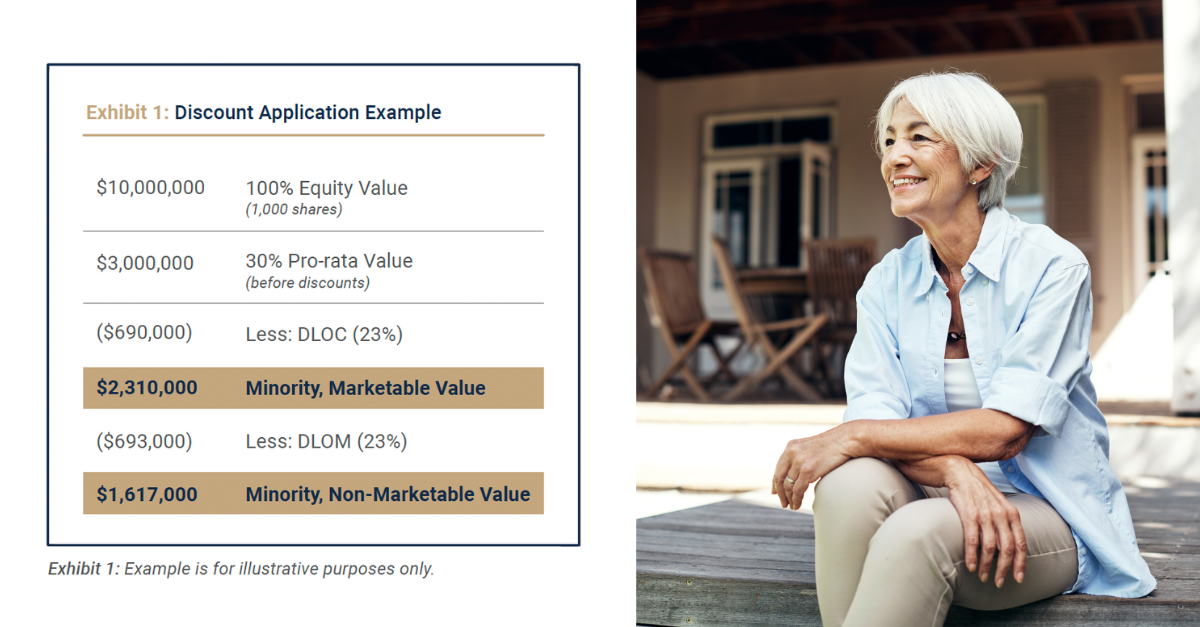

For both these reasons, the IRS permits owners to value their gifts of private company ownership at discounts to their total market value. Consider the following example. An entrepreneur owns a private company worth $10 million. They want to transfer 30 percent of their company to their only son.

Those shares have a public market value of $3 million. However, a 23 percent discount for lack of control reduces this value to $2.3 million. An additional 23 percent discount for lack of marketability decreases the declared value to $1.6 million. With this, they can give their son $3 million in ownership while only using up $1.6 million of his lifetime maximum estate and gift tax. In addition, all future appreciation, including any increase when the business sells and shares are marked to public market value, has been moved from the business owner’s estate to their son.

Note: This transfer will only be tax free to the extent that the business owner’s total lifetime gifts to his son do not exceed the estate tax threshold of $12.9 million.

2. Gifts to Irrevocable Trusts

The tax implications of gifting to an irrevocable trust that benefits your child are similar to those of making a direct gift. As the name implies, an irrevocable trust cannot be changed once established. Establishing a trust is more complicated than making an outright gift but can offer additional benefits.

For instance, the grantor can set up the trust, so he continues to receive income from the trust until he dies, with the assets in the trust passing to his heirs upon his passing. Trusts can also protect assets from creditors or, if the beneficiary gets divorced, from ex-spouses. An irrevocable trust is particularly useful for business owners with heirs who may struggle with financial responsibility.

3. Sale to Loved Ones

If you have already exhausted your estate and gift allowance, or need cash from the business for personal expenses, selling the business to heirs can be an attractive option. A common strategy involves lending money to heirs to purchase your company, thus creating a steady income stream. Family sales can present an attractive opportunity to shift future growth to the next generation while paying little or no federal gift tax on the transaction.

4. Sale to Intentionally Defective Trusts

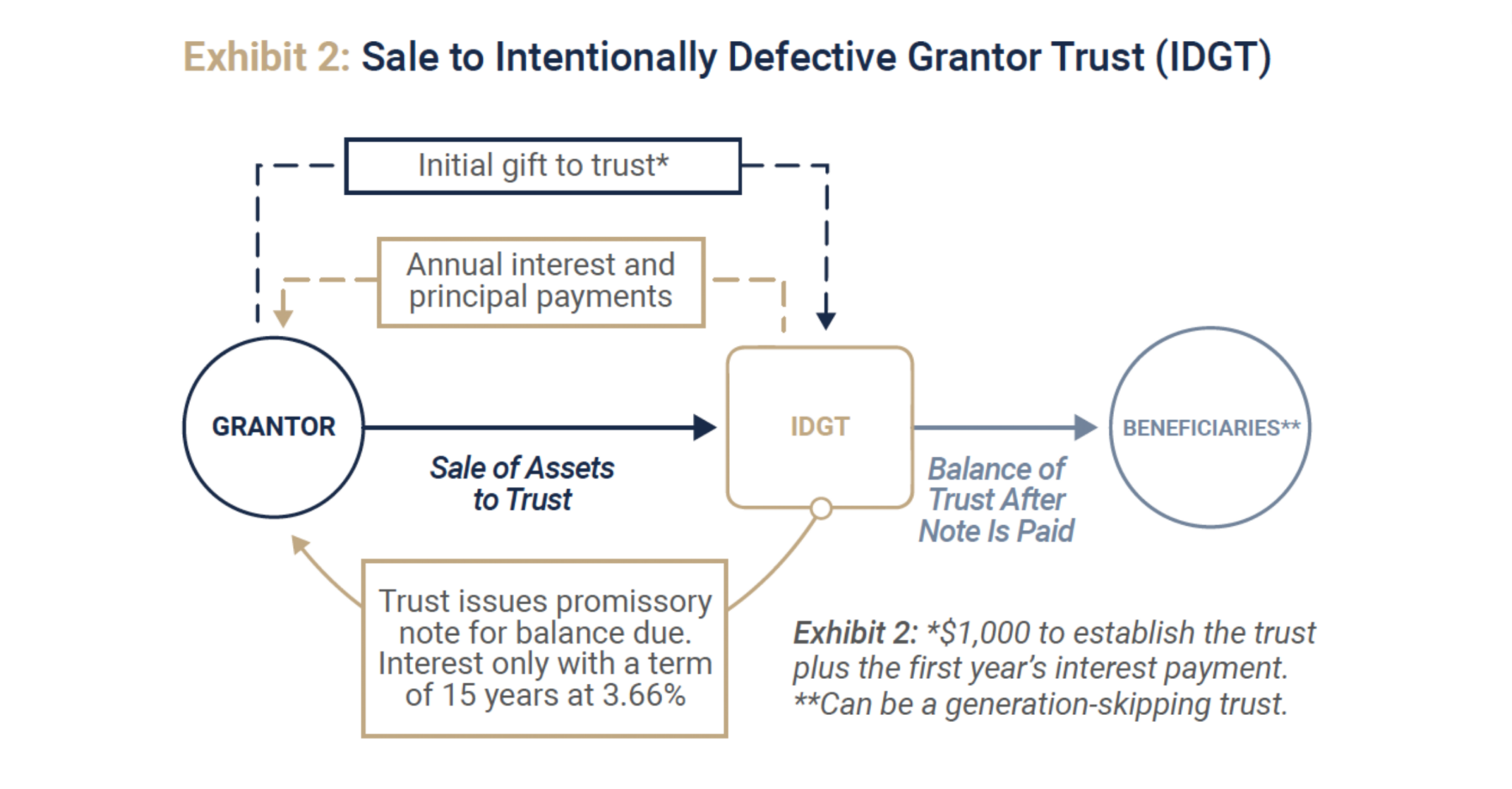

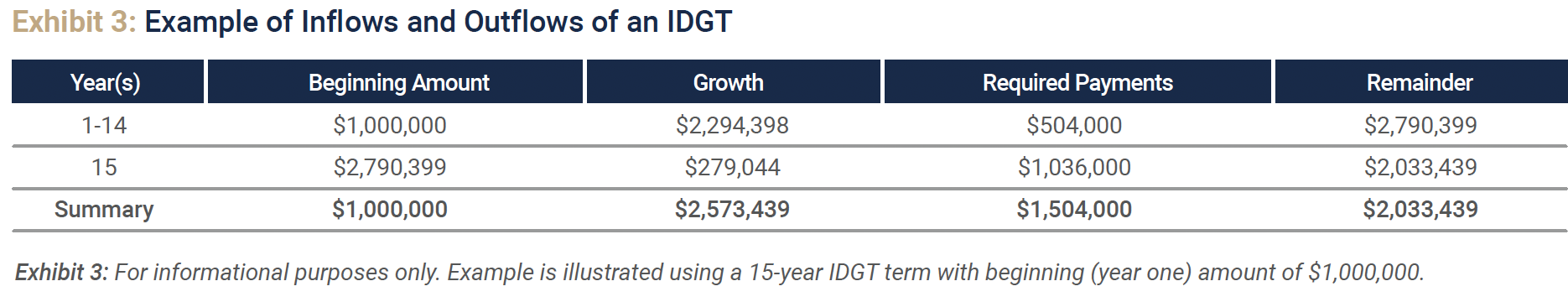

Another option is to sell your company to an Intentionally Defective Grantor Trust (IDGT). In this structure, you sell shares in your business to the IDGT in exchange for a promise that the trust will make regular interest payments to you throughout your lifetime and then pay out the value of those shares to your heirs when you pass away.

The shares you sell are immediately transferred out of your estate, freezing the size of your gift for estate tax purposes at their value on the day you complete the transaction. However, you continue to be considered the owner for income tax purposes. You, not your heirs, pay all taxes on investment income.

Why would you want to pay taxes on assets you no longer own? Consider that the taxes you pay are a tax-free gift to your heirs. When you die, your heirs will not have to tap trust assets to cover capital gains taxes. Moreover, you pay no capital gains taxes on the shares you sell into the trust; for tax purposes, you sell these shares to yourself.

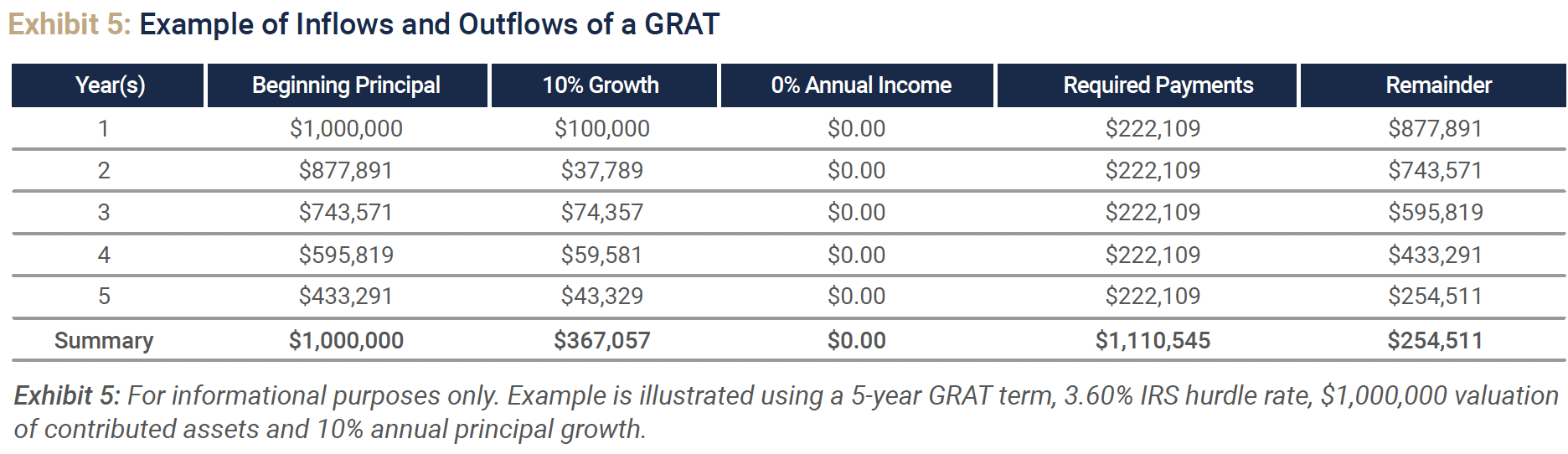

5. Sale to Grantor Retained Annuity Trusts

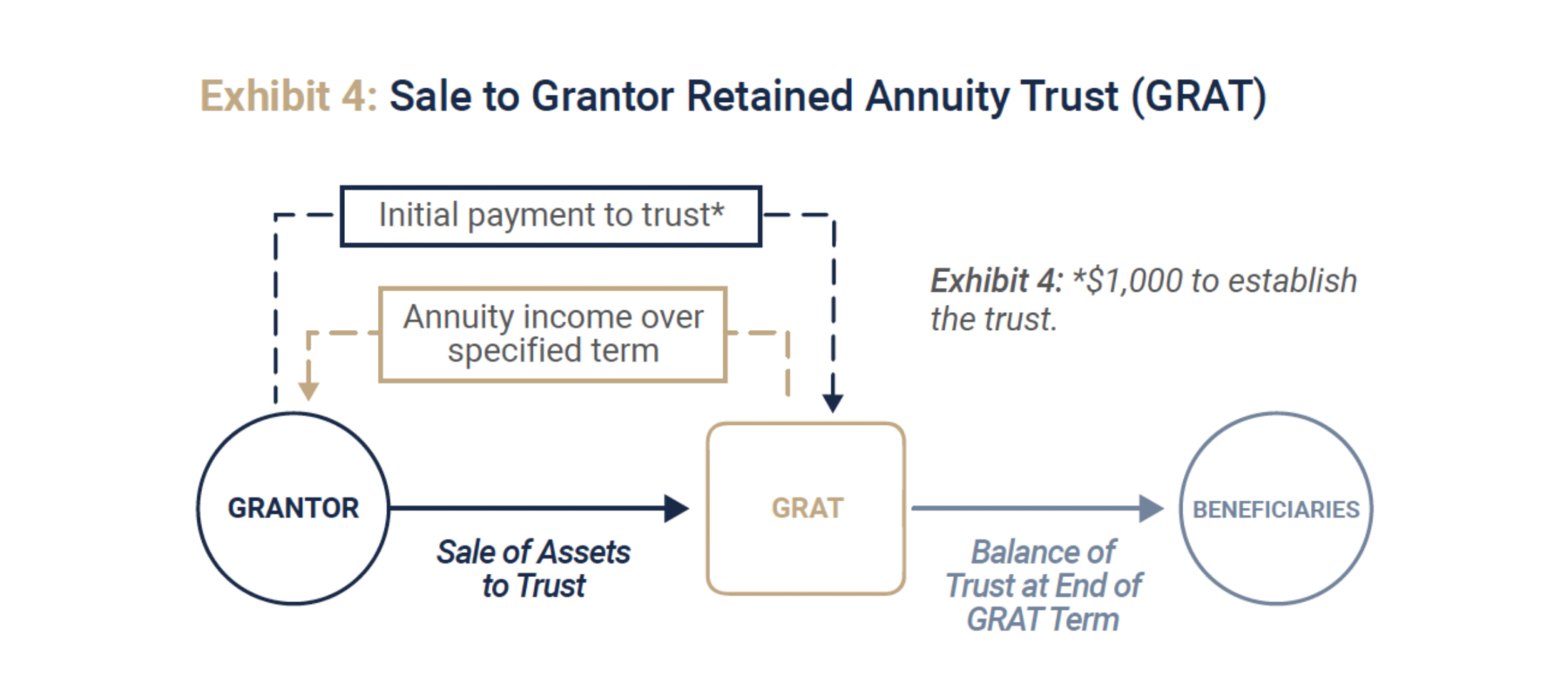

A Grantor Retained Annuity Trust (GRAT) can be another good solution. As with the IDGT, you sell your business shares into a trust, but unlike an IDGT, a GRAT gives an annuity in return.

Through this annuity, the GRAT will pay an annual amount for a specified term of years. An IRS schedule determines the amount of the annuity. Suppose the trust earns more in investment income than the payout, its value increases. If it earns less, the payment reduces the value of the assets in the trust. However, the mandated payment is relatively low, and most business owners find their companies grow more than enough to cover the outflow. As a result, the assets within the trust can continue to increase without affecting the ultimate estate tax liability.

After the trust’s term ends, payments end, and you no longer own the trust’s remaining assets. These assets are distributed to your children or other heirs. For gift and estate tax purposes, the gift value is the amount you contributed minus the value of all the annuity payments you received over the life of the trust.

A GRAT can be useful, but it has one major limitation, especially if you are planning to make gifts to generations after your children. The gift to the GRAT occurs when your annuity interest in the GRAT terminates. At that time, exemption from the generation-skipping transfer tax could be allocated to the trust, but the amount of exemption used would be based on the fair market value of the trust at the end of its term rather than when it was funded. That means any appreciation becomes part of your total gift for gift and estate tax purposes, pushing your estate closer to, or even over, the threshold for estate tax liabilities.

6. A 1031 Exchange

If your business owns real estate, such as a warehouse, factory, or office, you may be able to reduce your tax exposure with a 1031 exchange. In this strategy, you sell property your business owns and immediately buy similar property elsewhere without paying taxes on your gains.

Your basis in the new property is the basis of the old property; you will only have to pay taxes once you sell the new property. The new property must be “like-kind” or a business investment property. The 1031 exchange is a powerful tool to help you defer your tax liability on the sale of investment real estate, including property you own as part of your business. However, it is a complicated undertaking, and you should consult an experienced real estate lawyer before getting started.

First, you must identify the exchange properties in writing within 45 calendar days of the relinquished property's closure per one of the following rules:

- Three-Property Rule: Identification of up to three properties regardless of the total value of the property identified

- 200% Rule: Identification of any number of properties wherein the combined FMV (fair market value) does not exceed 200% of the relinquished properties' FMV

- 95% Rule: Identification of any number of properties regardless of the aggregate FMV, as long as at least 95% of the property is ultimately acquired.

You must also close on the replacement property or properties within 180 calendar days of the closure of the relinquished property.

7. Opportunity Zone Funds

Opportunity Zone Funds were created as a part of the 2017 Tax Cuts and Jobs Act to generate and facilitate investments into “opportunity zones,” or regions within the country that have been identified as being economically distressed. In short, an opportunity zone fund allows an investor to divert gains from any capital assets into one of the designated communities, allowing them to defer income taxes on those gains until December 31, 2026.

While the tax advantages of these vehicles may sound appealing on the surface, as an investment vehicle, there are certainly better options, and they may not be the best suited for all.

Navigating the complexities of estate taxes as a business owner demands a thoughtful and proactive approach. The potential erosion of a business owner's legacy due to estate taxes and the possibility of selling a cherished family-owned business or property underscores the importance of strategic estate planning. While each business owner's situation is unique, a range of proven estate planning strategies can be employed to mitigate the tax burden associated with transferring assets, potentially preserving substantial wealth. With proper implementation, the weight of estate taxes can be mitigated, securing a more prosperous legacy for both business owners and their heirs.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.