4Q 2021 | Quarterly Economic & Markets Review

“It is characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than mathematical expectations." -John Maynard Keynes

“The inflation we got was not at all the inflation we were expecting.” -Jerome Powell, Federal Reserve Chairman

Happy new year! As we look back on 2021 we see lots to celebrate and be thankful for. Notwithstanding the COVID surge at the end of the year the economy continues to recover, jobs are abundant, and most importantly from an investment standpoint stocks enjoyed a third consecutive year of double-digit returns. With many aspects of life normalizing after 2020’s shutdowns you might expect a sense of optimism to prevail, but instead Americans are increasingly anxious about the future.

One important barometer of America’s mood, the University of Michigan Index of consumer sentiment, dropped 12.5% in 2021 to 70.6, the lowest year-end level since the financial crisis of 2008. That index is based on the results of monthly surveys measuring consumers’ perceptions of their current financial situation versus a year ago and their expectations about their financial health a year down the road. Clearly, despite the strong recovery last year and the generally upbeat expectations for the US economy in 2022, Americans are nervous. Their anxiety is driven at least partially by uncertainty surrounding the path of the pandemic and the unsettling surge in cases of the omicron variant, but the unexpectedly large and persistent jump in inflation last year is also a factor. According to the US Energy Information Administration the average price of a gallon of gasoline rose 45% last year and the Consumer Price Index overall was up 6.8% for the year ending November, the largest 12 month increase since June 1982. Higher prices for nondiscretionary expenses including food and energy leave consumers with less to spend on other things, and to the extent they believe those price increases are permanent they foresee a lower standard of living, not a happy thought.

This theme of restlessness and apprehension despite strong economic and market environments provides a framework for our review of 2021 and a look forward at the forces and factors facing investors in 2022. Last year’s momentum carried into the early days of the new year, but the next 12 months will be a time of transition in several important areas with the potential to reshape the economic and market landscapes. Resurgent COVID, China’s economic slowdown, and surprisingly strong and persistent inflation are the topics most mentioned by forcasters looking into 2022. The risks are well defined. Global economic growth, while strong, is slowing. Global monetary policy, while still accommodative, is tightening. COVID, while better understood, still surprises. And all of these forces are at work at a time when valuations for essentially all asset classes are elevated.

The Delta and omicron variants of the coronavirus have shown how adaptable the virus is, supporting the World Health Organization's prediction that it will become endemic, a part of life like the flu that we’ll have to learn to live with. The scale, severity, and duration of future outbreaks will determine how this shift affects lifestyles and economies, and we’ll learn more as the year progresses.

The economic slowdown in China has garnered headlines and draws attention not only to the downturn in China's hugely overleveraged property market but also to the broad reorientation of the Chinese economy under Xi Jinping’s “Common Prosperity" policy. The stated goal of the policy shift is to narrow the wealth gap in China by promoting growth that supports the middle class by investing in high value-add sectors like high technology manufacturing and biotechnology. The transition from the old model, which focused on capital investments in infrastructure and real estate, to a knowledge-based and service-oriented high-tech economy is generally thought to be a smart long-term strategy but is fraught with risk in the short term. China's residential property sector is estimated to make up 20% of the Chinese economy, and as we learned from the collapse of Evergrande weakness in that sector has follow-on effects that dampen consumer behavior as well as government finances. So, the policy transition in China this year will be watched closely for its impact on what has been the world's fastest growing large economy and, by extension, the global economy as a whole.

The course of COVID this year and the impact of the Chinese policy transition are tiles in the broader global economic mosaic and will figure into the answer to the most important question facing investors now: the outlook for inflation. 2022 will reveal whether we have indeed transitioned to a new era of higher inflation after a decade of benign price increases that allowed fiscal and monetary authorities to keep both feet on the gas pedal. We've already heard a major shift in the tone of the Fed’s rhetoric, and if inflation is stickier than expected the transition to tighter policy will likely accelerate. As late as September the Fed “dot plot” revealed a contingent of FOMC members not expecting any increases in the Fed Funds Rate in 2022, and Chairman Powell still expected inflation to be “transitory.” Now the word “transitory” has been retired, the pace of tapering of quantitatve easing has been doubled, and rate hikes are projected to begin by summer at the latest. Even if inflation peaks in the first half of the year, as some economists expect, it is likely to remain above the 2-2.5% target range, so the Fed may find itself forced by structural forces to tighten more and more quickly than the market foresees. Wage growth, while strong, has lagged other prices, and the tight labor market suggests that 2021’s 5% increase in average hourly earnings may be a precursor to more wage pressure, making inflation more persistent. Prices of energy, food and other commodities can fluctuate and decline, but wage increases tend to be sticky. To the extent the Fed apprears now to have been caught flat-footed by the spike in inflation last quarter, we’ll learn in 2022 how the economy and markets will respond to the reduction and eventual reversal of the massive infusions of liquidity provided by the Fed over the last decade.

Equity Market Overview

There is no other way to say it: 2021 was an amazing year for global stocks. Equity investors stared down the risk factors discussed above: COVID, rising inflation, and the shift in Fed policy, and blithely drove the S&P 500 to 70 record closes on the way to a 28.6% return for the year. That made it the best year of a three-year run of double-digit gains, bringing the average annual return for the past three years to 26%. 2021 was also one of the least volatile years on record, ending with only a single 5% correction in the index. That statistic conceals significant underlying individual stock volatility as investors jumped from sector to sector based upon their shifting expectations about the direction of the economy. While the index itself sailed steadily along, 93% of stocks in the S&P 500 and 89% of those in the NASDAQ suffered at least a 10% decline at some point during the year.

Those shifting expectations about growth and inflation domestically and abroad also led to uneven style and sector performance over the course of the year. As new COVID cases subsided during the first few months of 2021 strong growth and accelerating inflation drove a quick rotation out of the stay-at-home stocks and into those benefiting from economic normalization, so value and small-cap stocks took the lead. That growth-to-value rotation gradually reversed beginning in June as the market began to price in expectations for tighter Fed policy, easing pressure on longer-term interest rates and thereby supporting longer duration sectors including, most notably, technology. US markets were mostly resilient in the fall despite a surge in volatility in September driven by the uptick in COVID cases, but emerging markets sank on concerns about China. More upbeat economic data in the fourth quarter lifted all segments of the market despite the increasingly hawkish tone from the Fed. When it all came together on December 31, US large-cap stocks were the winners again with growth and value indices delivering similar full-year returns in the mid-20% range for the year, small-cap stocks up 14.8% (with small-cap value far outpacing small-cap growth at 28% versus 3%) and developed international stocks finishing up 11.7%. After a good start emerging markets closed the year down 2.2% reflecting concerns about Russia and China.

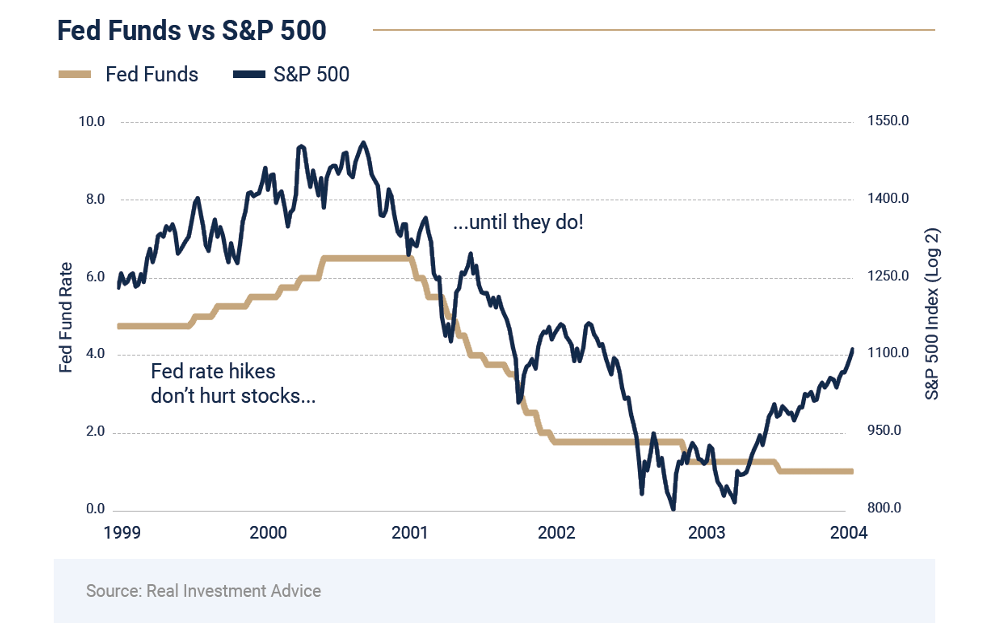

The backdrop is much different heading into 2022. With the Fed set to begin raising interest rates this year the potential impact of that policy shift after a decade of stimulus is the key question for investors. Looking back at a similar moment 20 years ago when the Fed embarked on a series of rate hikes we are reminded that as long as earnings and other fundamentals remain strong the stock market can continue to rise even as the Fed tightens. Only after six increases in the Fed funds rate did the economy and markets begin to roll over during that cycle. So it is not the first rate hike that matters, nor is it necessarily the second or third increase that definitively changes the outlook. With 2022 earnings expected to rise at a respectable 9-10% pace, the shift in Fed policy does not necessarily spell the end of the current bull market.

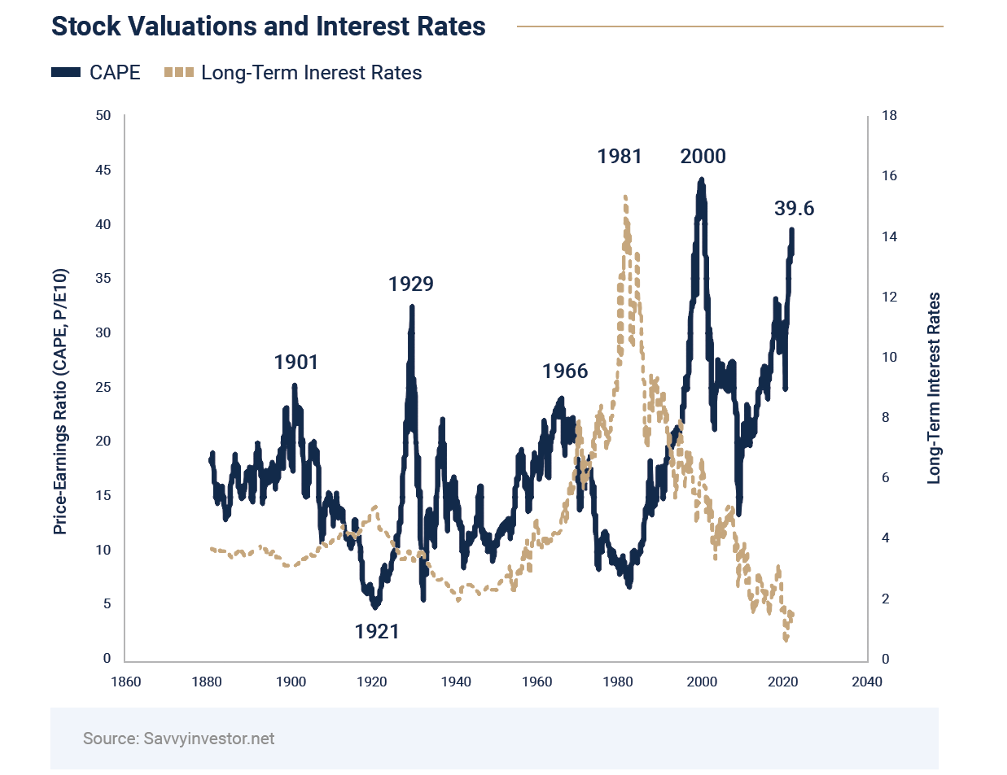

Other indicators counsel caution, however. By most measures stocks are now more expensive relative to earnings than at any time other than the 1990’s dotcom bubble. Bulls justify these valuations by pointing to the strong earnings growth and today’s low interest-rate environment, valid points but underscoring the market’s vulnerability to rising rates and disappointing earnings.

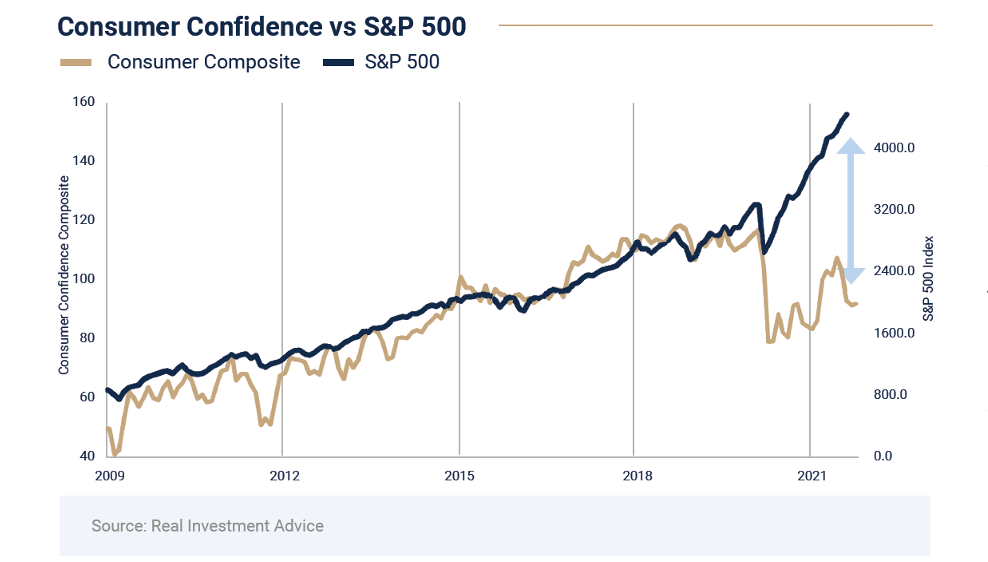

The disconnect between consumer confidence and the stock market which began in the depths of the COVID pandemic is unusual, as the graph below reveals. The gap exists because of the demand for goods and services and the stock purchasing power unleashed by low interest rates, enhanced unemployment benefits, and stimulus payments. To paraphrase economist John Maynard Keynes, whose policies advocate using fiscal and monetary policy to mitigate economic cyclicality, the "animal spirits" driving the economy are as important as the mathematical reality, and those policies were effective over the past two years. As the fiscal and monetary stimulus of the last decade is withdrawn we’ll need to watch closely for a shift in those "animal spirits" which could spell the end of the long, secular, liquidity- driven bull market.

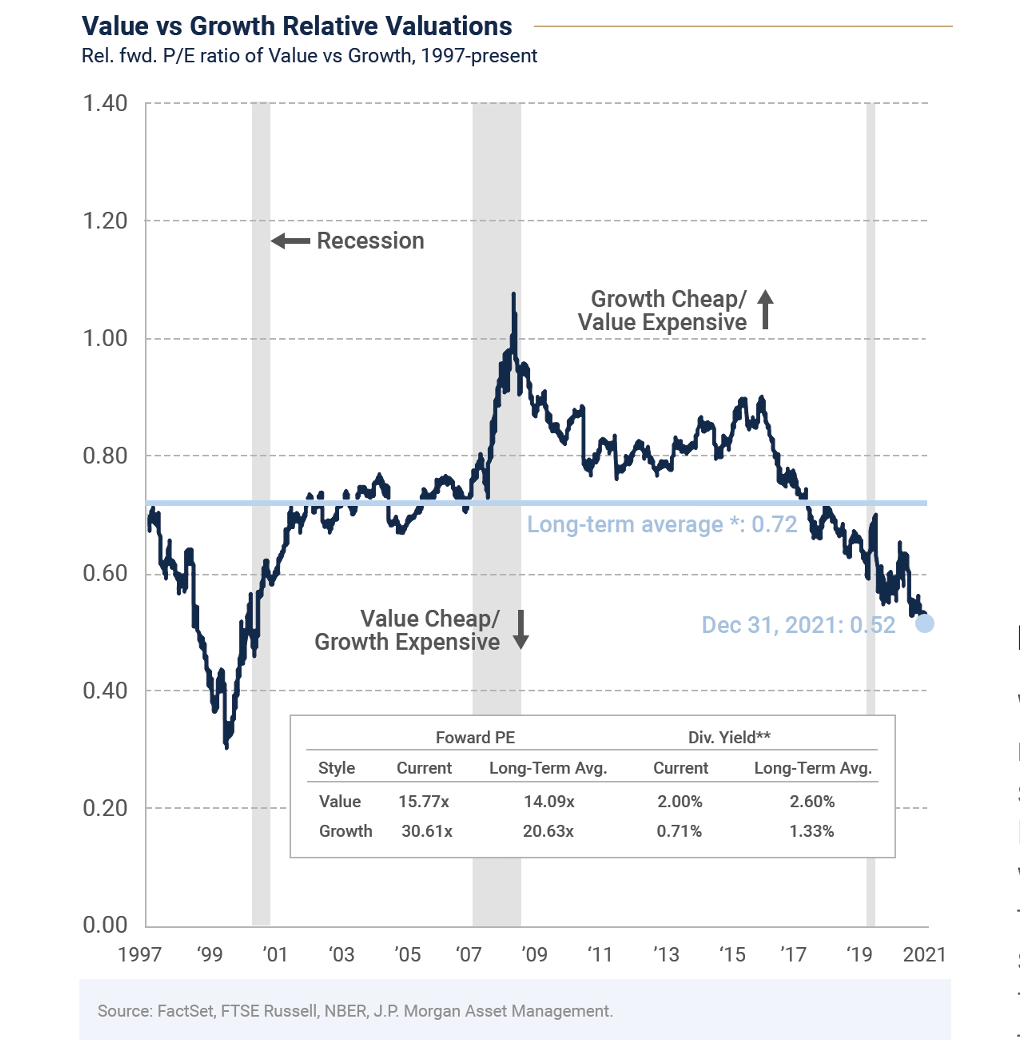

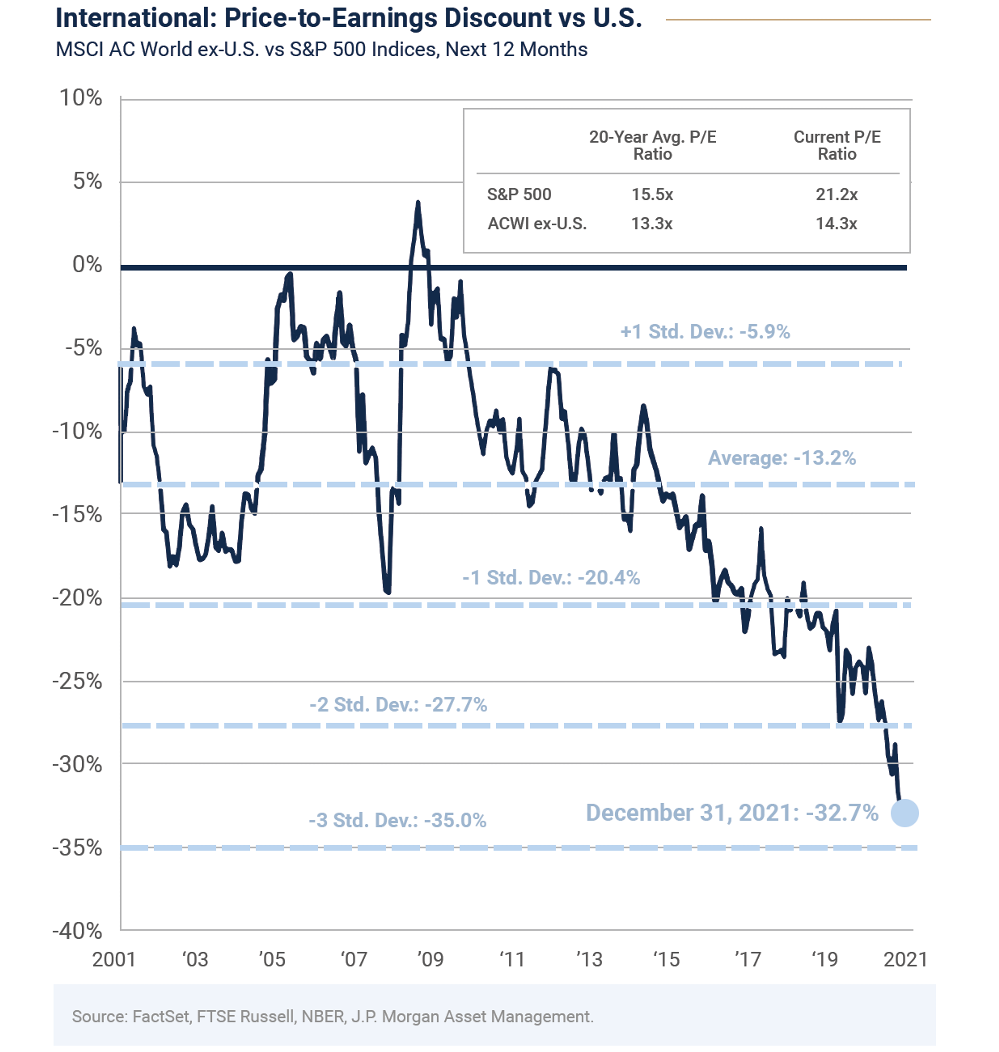

We return now to the well-trodden territory of size, style, and geographic diversification. The first quarter may have provided a glimpse of the future as small-cap stocks outperformed large, value stocks outperformed growth, and non-US equities at least held their own versus domestic stocks. US large-cap growth retook the lead over the remainder of the year as concerns about China dampened enthusiasm for foreign equities and the flattening yield curve increased the attractiveness of growth stocks. Relative valuations are now more favorable for value stocks than they have been since just prior to the dotcom crash, a common theme throughout this letter.

The valuation discount on non-US equities versus the S&P 500 is even more pronounced, in fact that gap is now its widest in history. Even so, foreign stocks are not inexpensive; at 14.3 times next year’s expected earnings the All Country World Index ex US (ACWI ex US) is trading at a slight premium to its long-term average earnings multiple of 13.3. However foreign stocks are very inexpensive relative to the S&P 500, which is now trading at 21.2 times expected earnings.

With valuations above pre-pandemic highs, stubbornly high inflation, and the Fed determined to step back its support, equity markets are unlikely to produce returns even close to those we’ve enjoyed over the past few years. 2022’s performance will depend upon continued strength in the global economy, solid earnings growth, and investors’ continued willingness to embrace risk. For now those conditions remain in place, and despite rising volatility equities remain the asset class of choice for long-term growth. Negative real interest rates leave investors no practical choice but to maintain their equity exposure.

Bond Market Overview

While stock investors enjoyed the fruits of the economic recovery in 2021, bond investors lost money for only the second time in 20 years and the fourth time since 1980. The Barclays US Aggregate Bond Index declined 1.5% for the year, with the price declines caused by rising interest rates more than offsetting the meager income investors received. The sequence of bond returns last year was driven by the same factors that drove the equity markets. Bonds sold off sharply at the start of the year as inflation increased and the market decided the Fed had stayed too dovish for too long. The iShares 20+ year Treasury ETF declined 14% in the first quarter. Rates subsequently declined and bonds rallied through the middle of the year as COVID dampened expectations for growth and inflation.

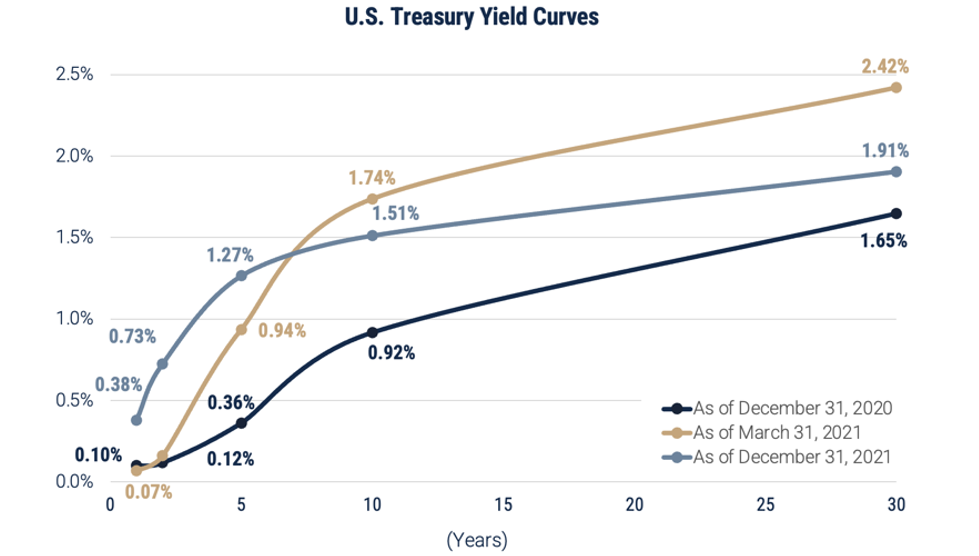

Things got interesting in the fourth quarter with rates rising along all maturities until December when the Fed's tough talk drove a quick flattening of the yield curve.

Strong economic growth and improving corporate fundamentals led to better performance across credit-related segments of the bond market last year. Despite record issuance for merger and acquisition activity balance sheets remain exceptionally robust, with lower leverage and more cash than historical averages. Credit spreads for high quality bonds remain tight, finishing the year at about 1% over comparable Treasuries. Our short duration, credit focused bond allocations held up well last year.

As we look out at the coming year from a bond perspective we are paying attention to the message being sent by the yield curve. The flattening curve over the last several months reflects the Fed's commitment to raise the Fed funds rate this year and the market’s belief that tighter Fed policy will effectively dampen inflation. As it stands today the yield on the 30-year Treasury bond is 2.1%, a level that reflects the bond market’s assumption that inflation will return to the 2% level or lower. We are not willing to make that bet at this point. As the Fed winds down quantitative easing this year the impact on intermediate and long-term yields could be significant. The Fed holds about 25% of outstanding Treasury debt, a potential supply overhang that could mean higher yields are necessary to induce buyers to soak up that supply. Given the meager compensation the market is affording investors for extending duration, we remain relatively hunkered down with an emphasis in bond portfolios on capital preservation and diversification.

Outlook

With the low hanging fruit of the global recovery now harvested, the next market cycle will be more challenging. Pandemic outcomes will remain important, but inflation and macro economic policy are the most important variables this year. The Fed and the market expect inflation to decline by midyear. If price levels continue to run hot we may see a reset to higher levels in long-term yields, bringing volatility to the bond and stock markets. The Fed is walking a tightrope as it seeks to tighten enough to dampen inflation without overstepping and quashing the economic expansion.

Important Notes & Disclosures

Wilbanks, Smith & Thomas Asset Management (WST) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation, or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

This document is intended for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred, or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty and does not represent the performance of any specific investment strategy.

Some of the information enclosed may represent opinions of WST and are subject to change from time to time and do not constitute a recommendation to purchase and sale any security nor to engage in any particular investment strategy. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.